International Monetary Fund. India to greater heights led by Modi.

International Monetary Fund:

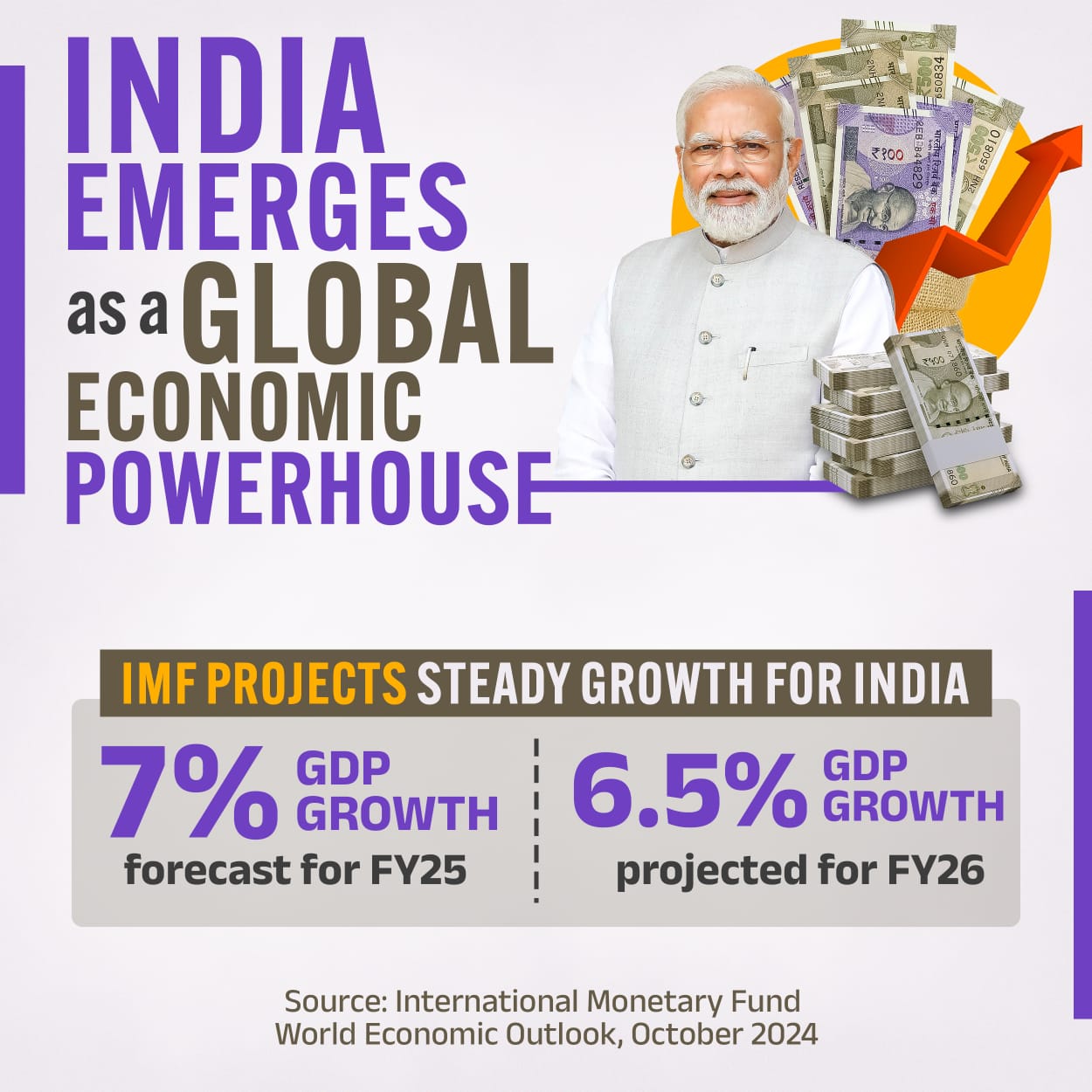

The multilateral lender International Monetary Fund expected India to grow at 7% in the current fiscal year ending March 31, 2025, and 6.5% in the next fiscal year (FY2025-26). World output was expected to grow at 3.2% in 2024 as well as in 2025.

The International Monetary Fund (IMF) maintained its June growth rate projects for India in its latest World Economic Outlook (WEO) released on Tuesday (October 22, 2024), to kick off the World Bank and IMF Annual Meetings in Washington. World output was expected to grow at 3.2% in 2024 as well as in 2025.

The drop in India’s growth from 8.2% in 2023 is “because pent-up demand accumulated during the pandemic has been exhausted, as the economy reconnects with its potential. The U.S. is projected to grow at 2.8% this year and 2.2% next year, an upward revision from the July WEO update.

“The global battle against inflation has largely been won, even though price pressures persist in some countries,” the IMF said. Inflation, which touched 9.4% in the third quarter of 2022, is expected to be 3.5% by the end of 2025.

A global recession has been avoided through the disinflationary process, despite a synchronized tightening of monetary conditions, the IMF said. However, downside risks now dominate the outlook. The risks had grown since the previous WEO releases in April and June this year.

The IMF has recommended a ‘triple policy pivot’ to respond to the “relatively mediocre” growth rate of 3.2% over the medium term. The first is moving to a neutral monetary policy stance, a process underway in many countries. The second is the need to build fiscal buffers after years of a loose fiscal policy. The third is structural reforms to increase growth and productivity, cope with aging populations and younger people looking for opportunities in some parts of the world, tackle the climate transition, and increase resilience.

feel that several conflicts around the world have made an impact on projections. Of course, there is geopolitical risk with the potential for escalation of regional conflicts and this might affect commodity markets. The Russia-Ukraine war continues and the conflict in West Asia has intensified, including in Lebanon, in recent weeks. Also, monetary policy remained too tight in some countries for too long and this impacting labor markets was a risk. Sovereign debt stress and activity in China being weak are some of the other risks.

Article written by and Editorial credit: State Bureau Chief Himanshu Nauriyal.